Small businesses were already struggling. Tariffs will end the viability of many.

Current Employment by Employer Size

- Small: 58.6 million jobs, 43.61% of total

- Medium: 39.0 million jobs, 29.04% of total

- Large: 36.8 million jobs, 27.35% of total

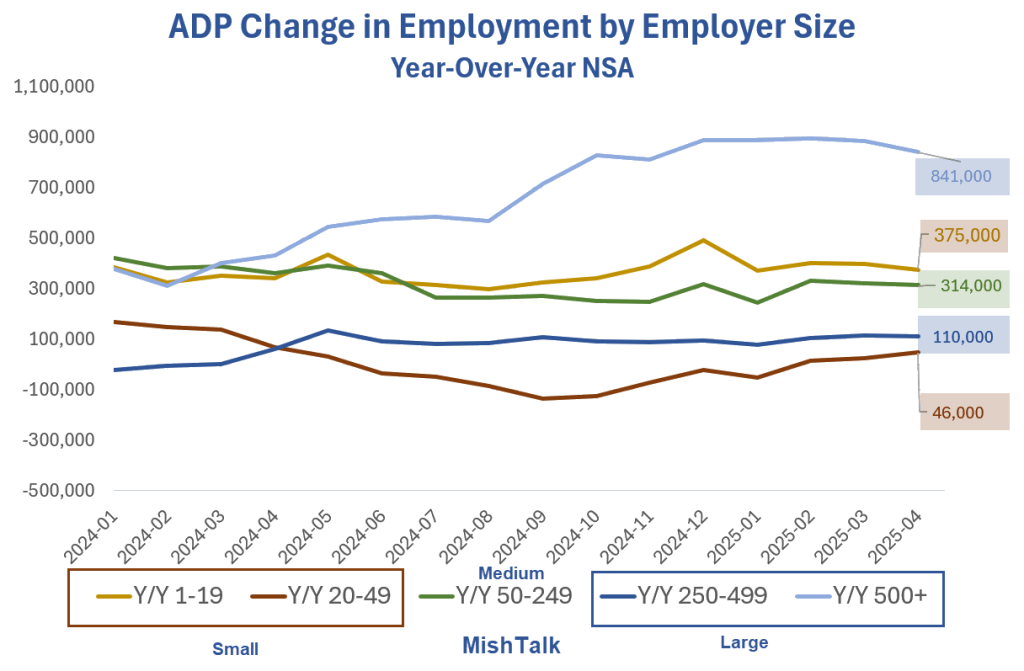

ADP Change in Employment by Employer Size

Year-Over-Year Change in Employment by Employer Size

- 1-19 Employees: 375,000

- 20-49 Employees: 46,000

- 50-249 Employees: 314,000

- 250-499 Employees: 110,000

- 500+ Employees: 841,000

Year-Over-Year Change in Employment S/M/L

- Small: 421,000 (25.0%)

- Medium: 314,000 (18.6%)

- Large: 951,000 (56.4%)

Despite accounting for 27.35 percent of jobs, large businesses accounted for 56.4 percent of job growth in the past year.

Which Companies Are Least Prepared for Tariffs?

That’s easy. Small businesses.

Trump hosted meetings for the auto manufacturers, then meetings with chip manufacturers, then meetings with executives at Walmart and large employers.

Trump handed out a few breaks, especially to the auto industry.

No one speaks for the small manufacturer who imports steel or aluminum to make parts.

And no one speaks for small resellers with supply chains to China or Vietnam.

Supply Chains

Large businesses will get hit too, but they are better able to move supply chains from China to India or Vietnam.

Then what?

Trump is likely to go after Vietnam next.

There is record uncertainty regarding these on-off moves by Trump, but the least able to afford repeat mistakes (or tariffs in general) are small businesses.

Apple can switch to India and Nike to Vietnam, but avoidance is disruptive, costly, and not an option for many small businesses.

Although India and Vietnam are winners (for now), none of these switches brought a single job back to the US (and won’t) factoring in higher prices and avoidance costs paid by consumers.

Consumers Face End of De Minimis Tariff Exemptions on $800 Packages

On May 2, I commented Consumers Face End of De Minimis Tariff Exemptions on $800 Packages

The trade provision that allows consumers and resellers to avoid duties on shipments worth $800 or less is ending for products made in China.

Hooray!? 40% to 100% Higher Prices

Who wants that? (Exclusions for cultist parrots who cannot think).

The original title of my post was “E-Commerce Sellers Face End of De Minimis Tariff Exemptions on $800 Packages”

Both titles ring true. Shortly after posting I opted for a shorter title.

For a while, I would not be surprised to see orders to China first shipped to Vietnam then from Vietnam to the US. But Trump will soon put an end to such tactics if they gain steam.

What Companies Won’t Survive These Tariffs?

Any business dependent on China will not survive.

Any business that cannot handle 25 percent tariffs on steel and aluminum will not survive.

US auto parts suppliers will find the auto manufacturers looking to cut costs somewhere. If that means Vietnam or Mexico (even for a while), those companies will not survive either.

Every business will face price hikes they will either have to eat or pass on. Businesses who can neither eat the cost nor pass it on will survive.

Large corporations are far more likely to survive. Hooray?

Republicans Against Trump

GOP Senator Rand Paul: “Tariffs don’t punish foreign governments. They punish American families. When we tax imports, we raise the price of everything—from groceries to smartphones to washing machines to prescription drugs.”

Rand Paul for President anyone? Count me in.

How Much Would a Made in the US iPhone Cost?

I discussed automation on April 7, 2025 in Sticker Shock: How Much Will an iPhone Cost with Trump’s Tariffs?

To avoid China tariffs, Apple Plans to Source More iPhones From India

“If consumers want a $3,500 iPhone we should make them in New Jersey or Texas or another state,” research firm Wedbush said in a recent note.

One reader commented “Instead of looking at this as a glass half full thing, Mish, you are just determined to be negative. There are adjustments that will be made to this new reality.”

The Old, New, and Persistent Reality

There are 335 million consumers all of whom benefit from lower prices.

Manufacturing employment is 12.7 million out of a total of 164 million.

Yet, we produce more output now than when manufacturing employment was 20 million. This is a result of automation and productivity.

But ta da, I am now on your side. I will wave my wand and double manufacturing employment to 25.4 million. TA DA!!!!

Now we have shoes that cost 3 times as much, appliances that cost 3 times as much, and exports of which that head to zero because the US would be the highest cost produce in the world.

But hooray!!! We have an extra 12.7 million people creating shoes, underwear, clothes, and lawn mowers that no one can afford unless of course we raise the minimum wage at McDonald’s to $45 an hour.

And cheap tomatoes from Mexico. Who needs em? Let’s pay agricultural workers $45 an hour too.

That is the “new glass half full reality” that I fail to see.

New Economic Theory “Tariffs Are a Tax Cut for the American People”

In one of the most stunning displays of economic stupidity in history, please consider New Economic Theory “Tariffs Are a Tax Cut for the American People”

Reporter: Trump is proposing tax hikes in the form or tariffs.

Karoline Leavitt Trump’s Press Secretary: Not true. He’s actually not implementing tax hikes. Tariffs are a tax hike on foreign countries, that again have been ripping us off. Tariffs are a tax cut for the American people. And the President is a staunch advocate for tax cuts.

The Amazing “Success” of Trump’s 2018 Aluminum Tariffs in One Picture

Those wanting more Mish sarcasm can find it in my March 13, post The Amazing “Success” of Trump’s 2018 Aluminum Tariffs in One Picture

I hope you can take a bit of headline sarcasm because the true story follows.

How Much Credit Expansion Does It Take to Grow Real GDP?

Detail Since 2019 Q4

- GDP: +2.55 Trillion

- US Government Debt Held by Public: +11.67 Trillion

- US Government Debt: +13.00 Trillion

- Total Credit: +27.33 Trillion

On April 2, 2025, I asked How Much Credit Expansion Does It Take to Grow Real GDP?

To grow GDP by $2.55 trillion since 2019 Q4, Total Credit Market Debt Owed (TCMDO) went up by over $27 trillion.

This would not happen with sound currency. And it is nothing tariffs can possibly fix, even if Trump understood trade (which he doesn’t).

Click the above link for President Nixon’s role in this mess.

The problem is an unsound dollar, fiscal spending out of control, and a Fed that is willing to monetize the debt.

Meanwhile, Trump is hell bent on destroying the dollar and increasing the deficit. Good luck with that.

Trump’s Plan to Make Manufacturing Great Again

For discussion of the absurdity of this setup, please see Trump’s Plan to Make Manufacturing Great Again in Pictures

The share of manufacturing employment keeps declining. What role did NAFTA play?

Instead of being the richest country in the world with the highest standard of living, the economic illiterates appear desperate to be more like Vietnam (a country that aspires to be more like the US).