Consumer sentiment soured in May, especially among Republicans.

The University of Michigan Consumer Survey shows a souring of economic mood and a rise in inflation expectations, especially among Republicans.

Consumer sentiment was essentially unchanged this month, inching down a scant 1.4 index points following four consecutive months of steep declines. Sentiment is now down almost 30% since January 2025. Slight increases in sentiment this month for independents were offset by a 7% decline among Republicans. While most index components were little changed, current assessments of personal finances sank nearly 10% on the basis of weakening incomes. Tariffs were spontaneously mentioned by nearly three-quarters of consumers, up from almost 60% in April; uncertainty over trade policy continues to dominate consumers’ thinking about the economy. Note that interviews for this release were conducted between April 22 and May 13, closing two days after the announcement of a pause on some tariffs on imports from China. Many survey measures showed some signs of improvement following the temporary reduction of China tariffs, but these initial upticks were too small to alter the overall picture – consumers continue to express somber views about the economy. The initial reaction so far echoes the very minor increase in sentiment seen after the April 9 partial pause on tariffs, despite which sentiment continued its downward trend.

Year-ahead inflation expectations surged from 6.5% last month to 7.3% this month. This month’s rise was seen among Democrats and Republicans alike. Long-run inflation expectations lifted from 4.4% in April to 4.6% in May, reflecting a particularly large monthly jump among Republicans. The final release for May will reveal the extent to which the May 12 pause on some China tariffs leads consumers to update their expectations.

Expected Inflation Key Points

- Current-year inflation expectations are 7.3 percent. That’s the highest since November 1981.

- Five- year inflation expectations are 4.6 percent. That’s the highest since January 1991.

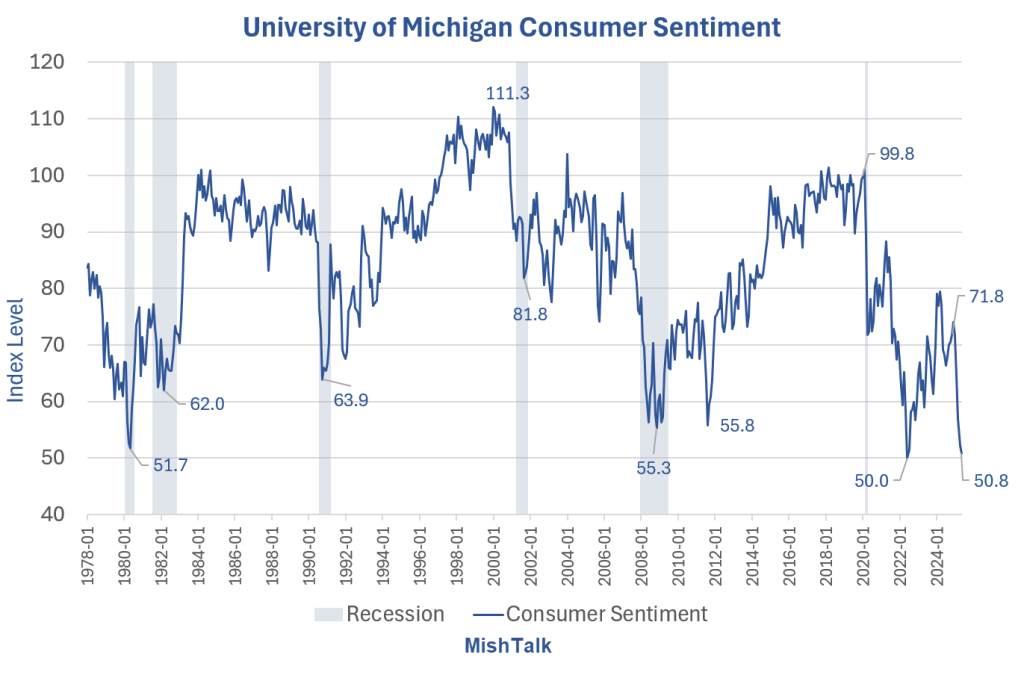

University of Michigan Consumer Sentiment

Other than the pandemic low of 50.0, consumer sentiment is the lowest in history.

Thank Trump for that.

It’s a Good Thing

It’s a good thing inflation expectations don’t matter.

Every FOMC meeting the Fed Chair, currently Jerome Powell, makes a fool of himself with nonsensical discussions on inflation expectations.

How can they matter? If you do think they matter, then answer this simple Q&A.

Consumer Inflation Expectations Q&A

- If you think the price of rent will jump next year, will you rent two houses now to beat the rush?

- If you think the price of rent will fall next year, will you hold off renting until rent falls?

- If you think the price of medical care will jump next year, will you have two operations now to beat the rush?

- If you think the price of medical care will fall next year, will you hold off on a needed operation?

- If you think the price of a vacation will jump next year, will you have two vacations this year and none the next?

- If you think the price of a vacation will drop next year, will you have no vacations this year and two the next?

- Will you stop eating? Eat more?

- If you car breaks down will you fix it twice? Wait until next year?

OK, maybe you wait for a sale to buy a coat. But you probably don’t by two. And if your coat rips, and you need one, you may not wait at all.

OK, some people rushed to but cars ahead of the tariffs. Will they buy a second car? Of course not.

They moved up a purchase of a car by a few month or so, perhaps less.

Businesses Inflation Expectations

Grocery stores can’t do anything at all, for obvious reasons.

Manufacturers can order ahead, and did to beat tariffs, but now they now have big inventories.

How many cars can dealers fit on their lots? And what if consumers don’t buy?

Dealers can only hold a few month’s inventory, assuming storage space, but at a cost and risk of declining prices if consumers throw in the towel.

Fed Study Agrees

No study should be needed to prove the logic of what I just stated. However we do have a study, and it’s by the Fed.

Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?)

Please consider Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?) by the Federal Reserve.

Mainstream economics is replete with ideas that “everyone knows” to be true, but that are actually arrant nonsense.

The direct evidence for an expected inflation channel was never very strong. Most empirical tests concerned themselves with the proposition that there was no permanent Phillips curve tradeoff, in the sense that the coefficients on lagged inflation in an inflation equation summed to one.

Finally, even if one is willing to entertain the idea that in some vague, mushy sense concern over costs and demand by individual firms facing fixed prices leads to a dependence of aggregate inflation on expected inflation, we are still left with the conclusion that short-run expectations should be the ones that are most important.

One might also be uneasy about policymakers’ relying too heavily on the assumption that inflation’s long-run trend will remain stable going forward so long as measured long-run inflation expectations do. Even if every one of my preceding arguments is judged by the reader to be completely unconvincing, it nevertheless remains the case that we have nothing better than circumstantial evidence for a relationship between long-run expected inflation and inflation’s longrun trend, and no evidence at all about what might be required to keep that trend fixed (beyond that it might involve keeping actual inflation from moving up too much above two percent on a sustained basis).

[Mish note: The lpreceding two paragraphs are a direct criticism of Fed policy as practiced by every Fed chair and people dismiss these reports without reading. The next paragraph is a hoot as well.]

Or would you justify the view that expectations “matter” by pointing to the inflation experience of the 1960s and 1970s, even though that period provides no actual evidence that workers or firms tried to boost their wages or raise their prices in anticipation of future price or cost changes?

Amusing Quotes

- Expectations are by definition a force that that you intuitively feel must be ever present and very important but which somehow you are never allowed to observe directly: R. M. Solow (1979)

- Pure economics has a remarkable way of pulling rabbits out of a hat. It is fascinating to try to discover how the rabbits got in; for those of us who do not believe in magic must be convinced that they got in somehow: J. R. Hicks (1946)

- Don’t interfere with fairy tales if you want to live happily ever after: F. M. Fisher (1984)

- Few things are harder to put up with than the annoyance of a good example: Mark Twain, The Tragedy of Pudd’nhead Wilson (1894

Do Inflation Expectations Matter?

I have discussed inflation expectations at least ten times over the years.

Here’s one from 2023 when I tangle with Bill Fleckenstein regarding the question How Do Inflation Expectations Impact Wages and Future Consumer Inflation?

Fleckenstein is an inflation expectations believer.

Phillip’s Curve Nonsense

Also see Yet Another Fed Study Concludes Phillips Curve is Nonsense

Despite the Fed’s own studies, every Fed president still believes in the Phillip’s Curve and Inflation Expectations.

They have been trained to believe nonsense.

Asset Price Expectations

Asset price expectations are another matter. That’s why we have bubbles and crashes.

People will buy houses and stocks if they think prices will rise. People don’t by stocks if they think they will fall.

But asset prices are not in either the CPI or PCE price indexes. Fostering asset prices bubbles is a constant mistake by the Fed.

The one place expectations do matter is in asset bubbles, and it’s the only place the Fed doesn’t look!

Inflation Expectation Reality

Inflation and media reporting of it drives expectations, not the other way around.

That’s a good thing for the Fed right now, even if the Fed is too clueless to believe the obvious (and their own studies).

Warning Regarding “Expectations Don’t Matter”

Doesn’t matter means just that. No direction is implied.

Doesn’t matter does not imply “won’t happen”.

There are plenty of reasons to believe inflation will trend higher.

The bond market is reacting that way. Walmart and the automakers are hiking prices.

And Trump is trying to talk tough on tariffs again.

Trump Blasts Walmart on Price Hikes, Sounds Just Like Elizabeth Warren

Yesterday, I commented Trump Blasts Walmart on Price Hikes, Sounds Just Like Elizabeth Warren

Republicans should be seriously embarrassed by Trump.

“Walmart made BILLIONS OF DOLLARS last year,” he wrote in a post Saturday on Truth Social. “Between Walmart and China they should, as is said, ‘EAT THE TARIFFS,’ and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

Lat year, in a letter to Kroger, Senators Elizabeth Warren and Bob Casey accused large grocery chains like Kroger and Walmart of being poised “to squeeze consumers to increase profits.”

Now Trump says Walmart should “EAT THE TARIFFS”

On April 11, 2025, I noted Tariff-Related Auto Price Increases Have Arrived, Will Get Much Worse

New Car Prices Are Ticking Up. Sales “Hangover” is Likely as Trade Wars Heat Up.

On May 15, I noted Walmart CFO Warns Price Hikes Are Coming, Blames Tariffs

Walmart says it will pass on some tariff price hikes.

And now Walmart has.

But nothing is baked in the mid-term cake because no one knows what Trump will do, including himself.

Technically Speaking

On May 3, I discussed Ominous Looking 10-Year and 30-Year US Treasury Yield Charts

The technical patterns on long-dated treasuries suggest rising yields. What about fundamentals?

The patterns have not changed and the fundamentals including the budget and Walmart are worsening.

A normal recession would reduce demand and prices. But the current setup with rising long-term yields looks more staflationary than anything else.

Fundamentally and technically the bond market reaction makes sense to me.