The answer varies widely by business, but we can estimate in billions.

Goods Trade Change from Year Ago in Millions

- November: -15,619

- December: -34,841

- January: -62,220

- February: -34,841

The total is -147,521. If we assume an average of -90,000 that’s about 1.6 months of front-running.

However, a decent chunk of that is physical gold, a financial asset that should not be part of any import-export calculation.

It was gold that threw the GDPNow calculations for a loop, lowering the base GDPNow forecast by two full percentage points.

US Gold Rush

S&P Global comments on the Gold Rush: The story behind January’s US trade data

Imports of goods into the US soared in January by a record amount. At first glance, the explanation appeared obvious: Companies front-loaded imports to avoid impending tariffs. A deeper dive, however, shows little front-loading. The underlying story is one about gold, polypeptide protein and glycoprotein hormones, and computers.

Gold

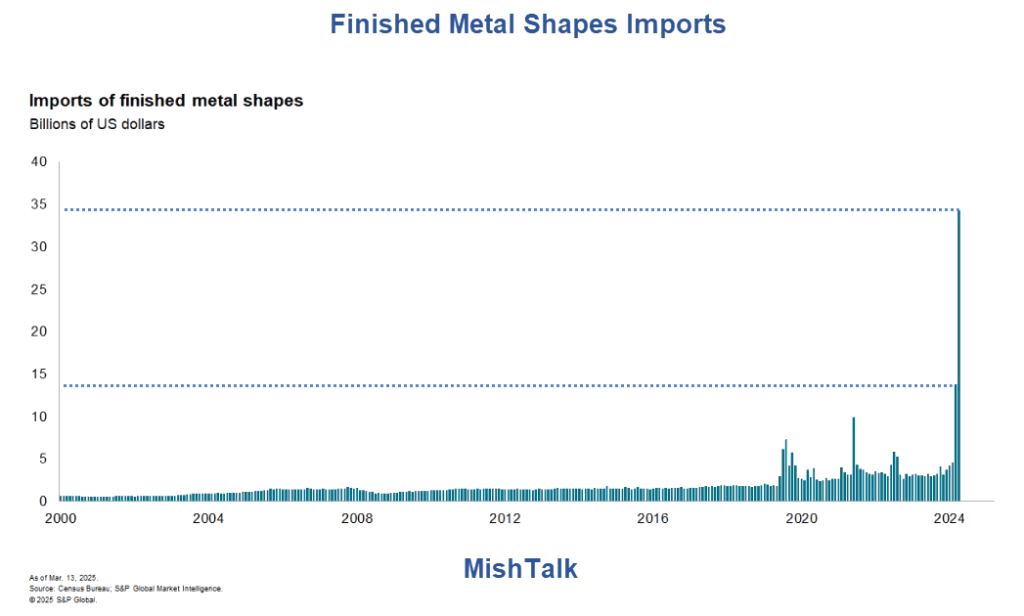

In December, goods imports rose by $11.3 billion. About 80% of this increase was in the category “finished metal shapes,” which includes gold bars. February saw an unprecedented import surge of $36.2 billion, with finished metal shapes contributing $20.5 billion, or 57% of the total. In 2024, finished metal shapes constituted a tiny fraction of total goods imports, 1.6%.

“Finished metal shapes” is an end-use category under the Census Bureau’s system of classifying imports and exports. The Harmonized System (HS) of classification identifies a product, and gold bars are a component of HS commodity 7115.

HS 7115 shot up by $20.1 billion in January. By mining the data, we determined that 97% of the additional gold bars in HS 7115 arrived via air freight — 99% of it through the New York City Port District — and the vast majority ended up in vaults in New York.

Why were gold bars moving from Switzerland to New York? Switzerland is the world’s premier gold refining hub. It transforms raw gold into standardized high-purity bars — sometimes just resizing them. Brick-sized gold bars in London weigh 400 troy ounces; to be traded in New York, they must be recast into smartphone-sized bars weighing 1,000 grams. Approximately 386 short tons of gold bars were flown to New York from across the world in January because gold commanded a higher price in New York than in London and other places.

Why was the price higher in New York than in London? Normally, the spot prices in these two places differ modestly, reflecting the costs of shipping, storing and financing. The possibility that gold bars will be tariffed created a disparity between what a bar of gold is worth in New York today and in the future, increasing demand in New York — raising its price. New York’s higher spot price then acted as a magnet pulling in gold bars from across the globe, mainly from Zurich.

Transferring gold from Zurich to New York should not change GDP, which measures current production. Our analysis indicates that the Bureau of Economic Analysis will treat January’s gold shipments the same way it treats nonmonetary gold imports, ignoring them. Some analysts take a different view, penciling in a first-quarter decline in real GDP, with net exports slashing more than 3 percentage points from growth.

Outside of gold bars, imports in January still sizzled. Nominal consumer imports increased by $6.0 billion, or over 8%, while capital goods jumped $4.6 billion, or more than 5%. Was front-loading the story here? That is hard to say.

Polypeptides protein and glycoprotein hormones

Pharmaceutical preparations (end-use 40100) grew by $5.2 billion, or 87% of the increase in consumer goods imports. By mining the data, we discovered that HS 293719 — polypeptide protein and glycoprotein hormones and derivatives — was the subgroup behind the increase in pharmaceutical preparations, soaring by $7.9 billion.

Nearly the entire increase, $7.8 billion, originated from Ireland. Likewise, nearly the entire increase, $7.7 billion, listed Indiana as the destination state. Why Ireland? Ireland has become a hub for producing pharmaceutical products. Why Indiana? Indiana is home to one of the world’s largest pharmaceutical companies.

Were pharmaceutical companies front-loading imports to escape an initial round of tariffs? The data does not specify. Outside of pharmaceuticals, the data showed few signs of front-loading consumer goods imports.

Computers and peripherals

Was the surge in computers and peripherals related to tariffs? That is hard to determine because breakthroughs in AI have led to a surge in high-tech hardware investments. For example, in December, nominal imports of computers and computer peripherals stood 57% higher than 12 months earlier.

It is not clear how much of January’s surge in computers and peripherals imports was related to impeding tariffs and how much would have occurred without the tariffs. One thing is clear: Outside of computers and peripherals, one sees little evidence of tariff avoidance in capital goods imports.

Overall, there was not much tariff avoidance in January. February and March will be different.

I disagree with that analysis because the January change from a year ago was an amazing $62 billion.

Finished Metal Shapes

About $47 billion of the import surge is physical gold.

That means there has only been just over 1 month of front running.

But that’s not uniform. Auto manufacturers likely did more, stuffing production on dealer lots.

Small manufacturers will get hit first, and Trump will ignore their complaints.

On May 2 or May 3, Trump is supposed to refine reciprocal further. He is hinting at more auto parts relief, but that is uncertain.

Since he reduced tariffs down to 10 percent except for China, there is a current open window of tariff avoidance by China through Vietnam, India, and Mexico.

Expect Trump to act to close that window.

Seriously Messed Up Supply Chains

We have seriously messed up supply chains in a futile effort to bring back manufacturing to the US.

That’s not going to happen to any significant. But to the extent that it does happen the US will not benefit at all because prices will skyrocket.

For example, the US will never compete with China or Vietnam on shoes or clothes pricing and should not even try.

Trump may have a month to fix this, and most likely a couple weeks. Small manufacturers will quickly go bankrupt under the crushing weight of 145 percent tariffs on China.

Imports Don’t Subtract from GDP

Bear in mind that imports have no influence on GDP.

Wait a second you say. The BEA’s formula is: GDP = Consumption (C) + Investment (I) + Government Spending (G) + (Exports (X) – Imports (M))

However, the BEA only subtracts what should not have been counted in the first place. For example, when you buy a tool at Home Depot, no one knows what percentage is from China, Mexico, or the US.

Assume 75% made in China and 25% US. But 100% of that purchase was added to Consumption (C). To make up for what is counted in consumption but shouldn’t be, the BEA subtracts imports.

The BEA should make this clear but doesn’t. I will. Imports do not impact GDP because they are not domestic product.

GDPNow

Compounding the issue, the economic models do subtract imports (again to take away what never should have been counted).

However, physical gold is a financial asset, so we need to subtract physical gold from the subtraction of imports.

This is how I arrived at ~1 month of front-running inventory, on average, varying widely from 0 to 3 months.

Related Posts

April 11, 2025: How Will Parts Hoarding and the Surge in Imports Impact GDP this Year?

A reader asked the above question. It’s a good one, answer below.

April 26, 2025: Six Auto Groups Lobby Trump Warning About Layoffs and Bankruptcies

In a rare, unified message, auto groups warn Trump about tariffs.

April 26, 2025: New and Existing-Home Sales Dip GDPNow a Bit Deeper Negative

The gold-adjusted base nowcast is -0.4 percent down from -0.1 percent on April 17.

April 27, 2025: Shipping Collapse: Port Workers and Truckers Wait for the Ships to Come In

Orders have been cancelled, but the primary impacts are not felt yet.